01

About us

Based on more than a century of industrial entrepreneurship and success with building companies, Bagger-Sørensen Equity A/S is focused on investing in small and medium sized companies with a growth potential.

We invest in companies where our active ownership and capital will enable the individual companies to pursue ambitious agendas realizing their full potential.

We develop companies in a responsible manner balancing the interests of society, customers, employees, partners and shareholders.

We are always open to dialogue around investment opportunities. Whether the decision to sell or onboard an investor has already been made or it is an early consideration, we invite you to make contact!

02

Our history

Our industrial history

1915

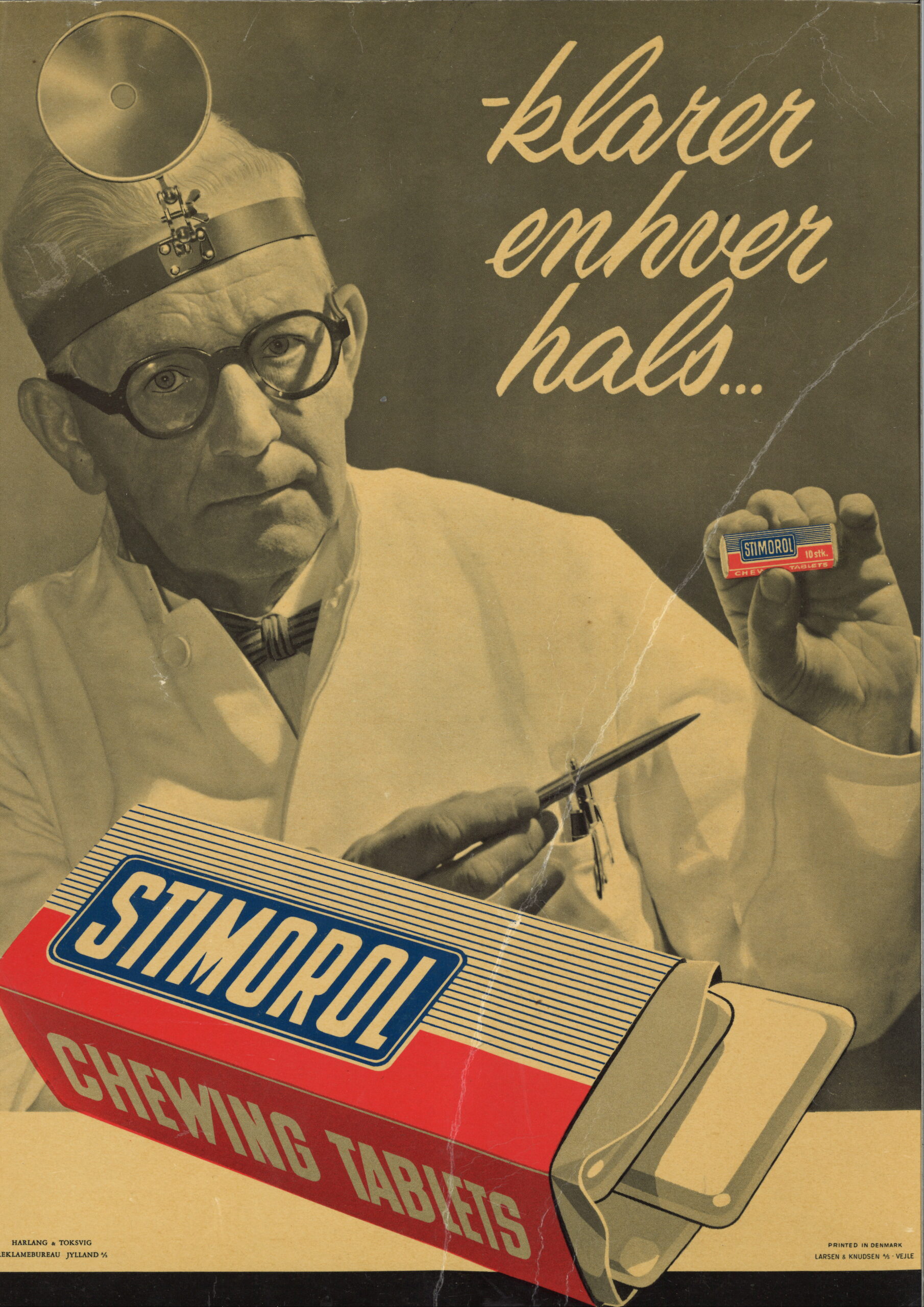

Vejle Caramel og Tablet fabrik (Vejle caramel and tablet factory) was established

Chewing gum production in Strandgade

1927

1939

The DANDY name was launched

Exports started up

1946

1952

New factory at Enghavevej

The first functionel gum (Stimorol) was launched

1956

1972

New factory at Dandyvej

Holger Bagger-Sørensen was appointed CEO

1975

1978

Acquisition of Fertin AB, Sweden

A factory was established in Zimbabwe

1982

1984

DANDY Fonden (Foundation) was established

Production of private brand to Kraft Foods France (e.g. Hollywood)

1987

1991

Holger Bagger-Sørensen retired as CEO and became Chairman of the Board in DANDY A/S

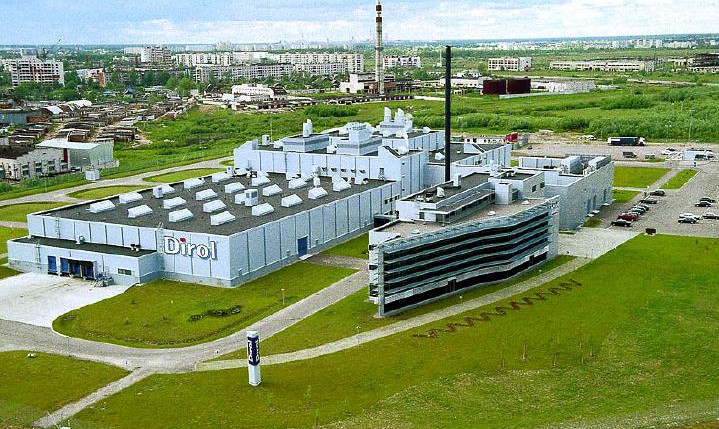

Inauguration of the Dirol factory in Russia

1999

2002

Cadbury bought the DANDY brands, the international sales organization and the factory in Russia.

The company name was changed to Gumlink A/S.

Inauguration of Fertin P2 (FDA approved plant)

2004

2009

Joint venture with Yildiz Holding, Turkey

Steen and Claus Bagger-Sørensen became Chairmen of the Boards in Fertin Pharma, Gumlink, Vecata and BS

2013

2015

The first 100 years were celebrated in Vejle with 1200 guests

Inauguration of the Fertin plant in Goa, India

Steen and Claus Bagger-Sørensen succeeded Holger Bagger-Sørensen on all board positions

2016

2017

Fertin Pharma A/S was sold to EQT (BS&Co. kept 30% of the shares)

The Bagger-Sørensen group moved to the BS HQ at Tabletvej in Vejle

2020

2021

EQT and the Bagger-Sørensen Family sold Fertin Pharma to Philip Morris

03

Cases

DANDY A/S

Industry: Confectionery

Ownership period: 1915-2002

Shareholding: 100%

Facts

Turnover:2.5 Bio. DKK

2.500 Employees

Creation of iconic Chewing Gum brands like Stimorol®, Dirol® and V6®

Strategic development

Brands, factory in Russia and all sales subsidiaries divested to Cadbury Schweppes in 2002 in order for the branded business to take part in a global consolidation within chewing gum and confectionery. Bagger-Sørensen family retained ownership of all B2B related activities continuing in Gumlink A/S.

Gumlink A/S

Industry: Confectionery

Ownership period: 2002 ->

Shareholding: 100%

Facts

B2B Chewing gum –> obtaining +60% SOM in European Private Label from 2002 -> 2008

Strong Operational Model developed and implemented allowing industry leading productivity performance and Customer Service.

Strategic development

Transformation in 2009 based on decision to globalize and improve competitiveness through formation of several Joint Ventures (India, Zimbabwe/South Africa, Mexico, Canada and Turkey). Manufacturing in Denmark seized in 2012 and Gumlink A/S became a holding company for Joint Venture investments within confectionery.

Fertin Pharma A/S

Industry: Pharmaceuticals

Ownership period: 1978->2021

Shareholding: 70% of shareholding divested to EQT in 2017

Facts

Turnover: 1.0 bn. DKK

800 Employees

Industry leading quality standards and global foot print

Strong innovation capabilities and Intellectual Property portfolio

Strategic development

Initially, established Fertin Pharma A/S as the largest CDMO within pharmaceutical chewing gum and smoking cessation gum. Further, developed the company into a world leading CDMO within convenient and pleasurable oral and intra-oral delivery systems across Pharma and Nutraceuticals working with multiple top tier global Pharma and Consumer Health companies.

Continental Confectionery Company Gida San

Industry: Confectionery

Ownership period: 2010 ->

Shareholding: 50%

Facts

Turnover: ~500 mio DKK

900 Employees

Double digit growth year on year

Global B2B sales and own Brands in Turkey/Middle East

Strategic development

Strong combination of own brands in Middle East/Turkey and B2B business model in rest of the world fueled by large scale modern manufacturing in a cost competitive environment coupled with strong innovation and R&D capabilities.

TabLabs Inc.

Industry: Nutraceuticals and Food

Ownership period: 2011-2018

Shareholding: 50%

Facts

Turnover increased from 2.5 Mio. CAN to 15 Mio. CAN

Significant increase in EBITDA

Facility in Langley, Vancouver, Canada upgraded, expanded and BRC (A) and Canada Health certified

Strategic development

Business was diversified into Nutraceuticals. Improved Product Development, Sales and Operations enabling attraction of large MLM customers in US, Canada and China.

Others

- Okono A/S (100% ownership – however the Nordik brand was divested in 2018)

- Medcan Pharma A/S (100% ownership – divested in 2019)

- Richmark GmbH (50/50 JV – exited in 2015)

- DANDY Zimbabwe, Ltd. (49% ownership – exited in 2015)

- Beechies, Ltd., South Africa (49% ownership – exited in 2015)

- Lohnpack GmbH (100% ownership – divested in 2010)

- Gumpole, Ltd., India (50/50 JV – exited in 2010)

- Stargum, Mexico (50/50 JV – exited in 2013)

- Arcedi Biotech ApS (90%)

- BS Renewable Energy Projects (Scotland) (100%)

04

Investment focus

We are particularly interested in investing in companies with certain criteria:

- Companies with growth potential

- Mature companies with a proven track record and an operational model that generates a positive cash flow

- Companies with a turnover between 50-500 mill. DKK

- A potential fit with our investment themes has priority over specific industries, so we are not restricted to certain industries

- Companies headquartered in Northern Europe

- We are not limited to specific industries, but invest based on selected themes

Companies not in scope

We have a limited number of industries which fall outside our direct investment focus:

- Heavy industry

- Basic infrastructure

- Arms industry

- Tobacco

05

Investment themes

There can be many motives for wanting to sell a company or on-board a new investor as a shareholder.

Regardless of the motives, i.e. generational handover (could be a multi phased process), the need for capital and risk sharing in pursuit of new growth avenues, resources to execute on an international expansion, capital to support an acquisition strategy or any other motive, Bagger-Sørensen Equity are interested in dialogue.

We are particularly interested in companies with products or services supporting UN’s Sustainability Goals and that have a logical fit with secular growth trends within Healthcare, Food & Ingredients, Technology and Sustainability.

06

Why choose us

Our history is industrially rooted and we have been involved in all parts of the value chain. We feel comfortable working in both B2B or B2C environments.

Our experience across several industries with full value chain coverage has generated a generic understanding of how to develop companies. Therefore, we do not limit our investment focus to certain industries as our approach is thematic.

Over time we have built experience within growth, innovation and operations in a global context. We know how important it is for the long term and sustainable development of companies to create value for customers and fulfillment for consumers – every day.

This takes a structured approach to continuous improvement of operations, disciplined identification of customers value creation and consumer needs fulfillment supported by efficient innovation processes.

Growth

- Define ambition and growth vectors

- Internationalization

- Mature & Emerging markets

- Long term Blue Chip Customer Partnerships

- Joint Ventures

- B2B and Brands

Innovation

- Clear link between Strategy, Growth Plans and Innovation

- R&D processes in regulated and non-regulated environments

- Identification of Know How and Proprietary Technology platforms

- Intellectual Property strategies

Operations

- Customer Service Focus

- Regulated and un-regulated industries

- Complex manufacturing & Supply Chains

- Global Supply Chain set-ups

- Continuous Improvement Programs

In essence, we are industrial minded and when we get involved in a company, we do it with a genuine interest in building better companies – long term with respect for the history and culture in the companies. We believe a focus on building better companies goes well hand in hand with creating satisfactory return on invested capital.